Vay commercialises, Uber shuts Drizzly, car-sharing exits, Picnic €355M, Finn €100M and many more raises

- Barak Sas

- Jan 22, 2024

- 8 min read

Ride-Hailing & Taxi, Buses & DRT 🚙🚐

BluSmart, Indian ride-hailing, introduces “surge price”, going back on previous promises not to do so. The new pricing is transparent - the company defined “Rush Hours”, in which rides will be more expensive, but surge is not dependent on excess demand. Interestingly, the company created two sets of “Rush Hours” - one for city rides and one for airports.

In Africa, Bolt is struggling with “offline trips”, in which drivers solicit riders to cancel the trip and pay directly to them, often at a lower price. To tackle this, Bolt is introducing a new rider cancellation option, allowing riders to select “driver asked to pay off-the-app’”. Bolt says off-line trips are also a potential safety concern.

Ola Cabs’ parent company, ANI Technologies, cut losses in the Ola Cab arm by 65%, from circa $370.7M loss in FY22 to $130.2M in FY23. Sales grew from $146.8M to $239M. In comparisonment, Uber saw net losses widening, from $23.7M to $37.4M.

Cabify gets €15M venture debt financing facility to advance its “green” fleet. Uber launches EV rickshaw service in Ayodhya, India, with intent to continue with the launch of UberGo, its affordable car service, and Uber Intercity. Namma Yatri, rickshaw ride-hailing, launches in Delhi. Careem working with Saudi Arabia Railways to set dedicated pick-up and drop-off areas in five additional rail stations. Uride, Canada ride-hailing, is wage subsidised by local government, to allow drivers a living wage. Hong Kong’s taxis to accept Chinese e-payment apps; there are 46,000 taxis across Hong Kong. Revel celebrates 2 million rides. Tesla Superchargers are overwhelmed by Uber drivers in NYC.

PeekUp is a new ride-hailing service set to launch in the Philippines this year. Today Grab is the only operator in the country, with InDrive set to launch as well. Kabby wants to be the 1st ride-hailing service in Newfoundland and Labrador, Canada. Mbay Mobility wants to launch e-taxis in West Africa.

FlexRide Milwaukee, by Via, celebrates 50,000 completed rides. In 2023 the service registered 41,000 rides with 4,000 unique riders, and the service has gained additional funding to continue in 2024. WeRIDE is a microtransit project shared by three Arizona cities in the greater Phoenix region, powered by RideCo. Cost per ride varies between $30-$40 per ride. DRT bus in Jeju Island, South Korea, mixing fixed route operation on peak times and on-demand on off-peak. The Routing Company in Chillicothe, Ohio. Nemi in Girona, Spain. Liftango expanding coverage in rural North Lincolnshire

Car Sharing/renting 🚗

Report by Berg Insights says car-sharing is booming, growing from 123.4 million users and 575,000 vehicles in 2022 to 269.4 million users and 979,000 vehicles by the end of 2027. Car-sharing schemes are operated by OEMs, rental & lease companies and specialist companies (list inside).

Finn, German-founded & US car-subscription, raises €100M on a €600M post-money valuation. Funds will be used to expand EV fleet and develop tech and added services. Car-subscription is a troubled segment (Fair.com, Onto, Cazoo); Finn leases new cars, bought bulk from OEMs, for a period of 12 months. In 2023 Finn had 25,000 subscribers, ending the year with €160M ARR.

Renault, who just completed the acquisition of Zity, shut down its Paris operations. The company attributes the departure to “factors external to the company such as significant damages repeatedly suffered by the fleet have diminished both the availability of the vehicles and the qualitative assessment of the service by users”.

GreenMobility signs an agreement with Dutch car-sharing company MyWheels to exit the Netherlands. GreenMobility will transfer customers and employees to MyWheels, and will cease operation in the country on February 1st.

Spark, Lithuania-founded electric car-share, exits Romania. The company cites “unfavourable business environment and the lack of concrete support from the local authorities”. Evo Car Share expands in Vancouver, Mol Limo tightens terms - increases age limit to 20 and forbids pets.

Treepz 2023 review: 668 vehicles signed up for the P2P car-sharing service, which generated $1.2M in revenue from 1,290,611 passenger trips completed across four African countries and Canada. Note that in 2023 Treepz switched its business model, from a bus-commute to a P2P car-sharing, so numbers, especially passenger trips, are a mix of both services.

Micromobility 🚲🛴

Ryde in 2023: launched 11 new cities and became the largest shared e-scooter operator in both Norway and Finland; MaaS integration with Ruter As; EBIT positive; with 20 million trips from 1.5 million customers.

Old news by now, but requires mentioning: Dott and Tier merge. The combined entity, which will continue using both brand names (also competing on tenders against each other?), has annual revenue of €250M, presence in 20 countries and over 350 cities. In the new combined entity, the CEO and COO come from Dott; Tier’s former management to men Chairman and CFO positions.

Bolt secures a licence for 2,500 micro-mobility vehicles in Oslo until March 2025. Nextbike launches a bike-sharing system in Barcelos, Portugal.

Delivery 🍽🧺

Picnic, Dutch online grocery, raises €355M, bringing total funding to €1.3bn. Funds will be used to continue expansion across France and Germany and enhance robotic automation abilities.

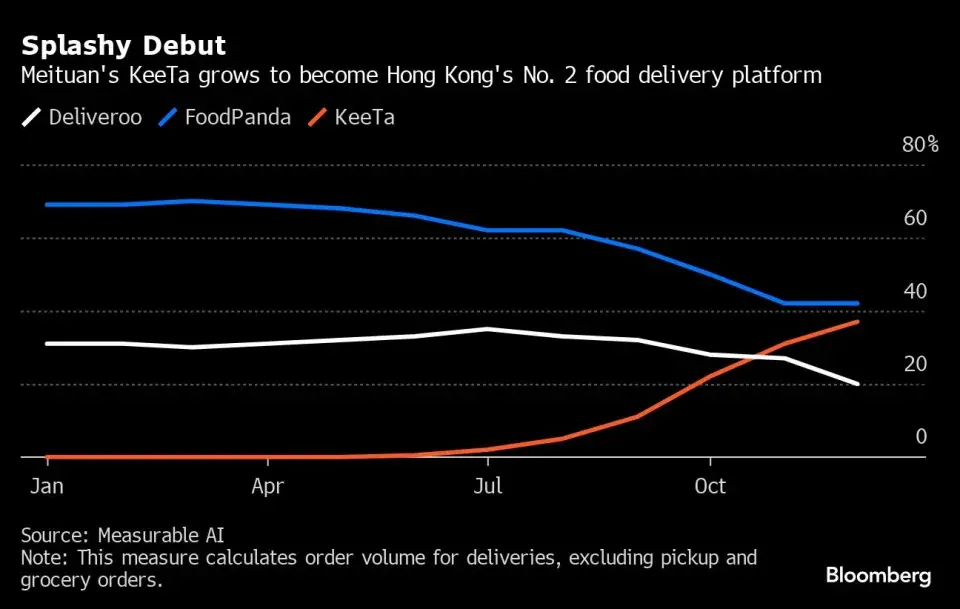

Hong Kong: Muituan’s KeeTa, food delivery service, becomes #2 in Hong Kong, with 37% market share, six months after launching. Foodpanda holds at #1 with 42%, with Deliveroo dropping to 3rd place with 20%. KeeTa entered Hong Kong with aggressive subsidies. When comparing together with pickups and grocery delivery - which KeeTa does not offer - KeeTa with 21% is in 3rd place after Deliveroo’s 25% and foodpanda’s 54%. Average order size is also smaller with KeeTa - HK$102 (±$13) - versus HK$168 (±$21.5) for foodpanda and HK$185 (±$23.5) for Deliveroo.

Vietnam: Be Group raises $30M to fend off Grab and Gojek. Funds will be used to develop “ride, delivery and digital financial services, as well as to venture into new markets and segments of the consumer and transportation sectors”. According to the company, it controls 35% of the ride-hailing market.

Uber shuts down Drizly, alcohol delivery service. Drizly, acquired for $1.1bn three years ago, is being replaced by Uber Eats and will not continue as a separate brand.

Just Eat Takeaway to close its in-house delivery service in Paris. Across Europe the company mostly uses its own employees to run deliveries, but says this puts it in a competitive disadvantage in France, and therefore will start working with couriers from Stuart.

Grubhub agrees to pay >$3.5M to resolve a lawsuit by Massachusetts, for illegally charging excessive fees from restaurants during the pandemic, when a price cap was put in place by the state. Grubhub charged the full 15% allowed - but added 3% credit card transaction fees - which were frowned upon by the court.

Walmart is bringing drone deliveries to 1.8 million more Texas households, via partnerships with Wing and with Zipline. And Wing unveils larger drones for heavier packages - capable of carrying up to five pounds (2.2 kg) on a 12 mile round trip.

Sway, formerly known as Returnmates, raises $19.5M to manage e-commerce returns. UrbanStems, NYC flower same-day delivery, raises $5M.

Stash is a local Swiss grocery delivery company. The company is fighting the government for a permit to work on Sundays, while Uber and Just Eat enjoy the ability to.

Grab Malaysia adds a new fee and changes courier earning framework and is taking heat from couriers. Hundreds protested outside the company’s HQ. In Bangladesh, foodpanda is fined 1 million Taka (±$9,000) for abusing its competitive power; the local competition authority is ordering foodpanda to allow restaurants to partner with rivals. Zomato introduces daily payouts to its small restaurant partners, replacing the weekly payment structure used so far. DoorDash adds five new retail partners to its marketplace. DoorDash now has over 100,000 non-restaurant storefronts on the platform, with nearly 2M products.

If Getir’s acquisition of FreshDirect didn’t make sense to you too - read this. Can’t vouch for the reliability, but it sure is interesting.

Autonomous & remote-driving 🤖℡

Waymo to start testing robotaxis on Phoenix highways, expanding the commercial services the company offers in the city. Safety-driver rides have been piloted during the last year, and now the scheme will start with employees. Also Waymo seeks to expand driverless service to Los Angeles.

Vay, teledriving, begins commercial operations in Las Vegas. Vay operates a per-minute car-sharing scheme, and the vehicle gets/leaves the customer in a teledrive mode. Taking free-floating to the max.

Kodiak introduces a custom-built semi-truck full of redundancies to assure operations (communications, computer power) and safety (braking, steering). The company chose a OEM-agnostic approach, saying that OEMs are just not ready yet. First driverless miles (in Texas) are planned for this year, with commercial routes for 2025. Video.

TuSimple is voluntarily delisting from the Nasdaq and transitioning into a private company. Remember that in December the company shut down its US operations, as it transitions HQ & operations to Asia.

Trilvee, teledriving, shuts down.

Flying cars 🚁

Horizon Aircraft, Canadian eVTOL manufacturer, debuts on Nasdaq and signs $500M deal for the purchase of 100 aircrafts.

Sirius Aviation AG unveils world’s-first hydrogen-powered eVTOL. First demonstration flights scheduled for 2025, commercialisation in 2028.

eVTOLs can not agree on a charging standard, and airports (vertiports) are now being equipped with two different types of chargers.

Lilium partners with Fraport, airport operator, to work on development of a commercial eVTOL network. For now the partnership focuses on lobbying and regulation.

OEMs 🛺⚡️

Kia reveals new commercial EV lineup at CES 2024. This newsletter mostly ignored CES this year (In short: EVs, autonomous, AI and in car-tech, you can read more TechCrunch, Neckerman, Papandreou) but I am pointing this out because it is another attempt (Arrival) to reinvent ride-hailing and delivery by building Purpose Built Vehicles, and there is a partnership with Uber in place to do so. Neckerman (again) with a good analysis on that announcement.

Sometimes, small news carries a big impact: Arrival is being sued by its landlord over unpaid rent, which in my mind, is another strong signal of the end. Why? Because this means Arrival is late on payments, the landlord has exhausted attempts to collect, and this lawsuit can also point to anticipated property protection in case of chapter 11. One doesn’t need to be Sherlock Holmes to know Arrival isn’t doing well - past years have seen the company struggle and it recently missed interest payment on its convertible notes.

VinFast to promote its EVs to Gojek’s driver-partners in Indonesia. VinFast introduces electric pickup truck - still in concept mode.

Xos, an electric truck manufacturer, is acquiring ElectraMeccanica, designer and assembler of electric vehicles. ElectraMeccanica was in the news recently, after a merger with Tevva fell through and entered legal battles.

Phoenix Motor is now the owner of bankrupt Proterra Transit.

Gig economy 💰

Instacart and DoorDash hike fees in Seattle following a new wage law that went into effect on January 13th, which according to both companies equals to an hourly wage of circa $26, above the city’s regular minimum wage of $19.97. Instacart limited service areas, set tipping default at $0 and plans for a new fee; DoorDash prepares Settle’s dashers for less work, terminates Top Dasher and Priority Access programs, and plans for a new fee. Doordash: “This major policy shift is unprecedented, and we will continue working to chart the best path forward for the communities we serve by testing and reviewing any changes we make”.

The US Department of Labor introduced a new rule, revising guidance on how to determine an employee from an independent contractor. Gig-economy companies say there is no immediate impact to the app-based gig economy.

GigEasy, insurance for gig-economy, raises $1.3M.

In other news 📰

In Los Angeles, a universal basic mobility-wallet scheme has been running since April. The scheme sees low-income residents receiving $150 per month to use for any type of transportation, other than owning or operating a car. Early results show that most money has been spent on ride-hailing services, and most rides were used with public transport. For more.

D-Orbit raises €100M for space logistics services. Bumper, BNLP car repair fintech, raises $48M. Funds will be used to grow in the UK, Ireland, Germany, Spain and the Netherlands. Burro, autonomous solutions for the agriculture industry, closed its $24 million Series B funding round. Agtonomy, advanced autonomous and AI solutions for agriculture, raises $22.5M.

New taskforce, initiated by Bolt and Cabify and includes 18 leading mobility companies, to guide EU policymakers on mobility innovation.

By collecting and analysing data, GoMetro was able to help switch minibus taxis in South Africa to electric vehicles. Diagnostics were installed on 50 vehicles, and results show that 43 of those could have completed their daily operations on a single charge. For more.

Skarper is working together with Red Bull to develop the world's first click-on, click-off e-bike drive system. Google Maps adds Waze's in-tunnel navigation feature, adding support for Bluetooth beacons. TomTom traffic index. 387 cities were assessed, and traffic has just gotten worse. Worst city to drive through rush hour in? London.

Comments